Hey Fintech Friends! In this edition of our FinWise newsletter, we’re excited to share a variety of top hits ranging from recent announcements, product and partner news, to insights from your favorite industry experts. Ready to Fly with FinWise? 🦉

News recap.

- Latest Podcast(s)

- Sarah Fernandez with Kaufman Rossin and Sarah Grotta discuss the critical importance of Regulation E (Reg E) in the banking and fintech sectors.

- Industry experts chat about financial trends and the future of fintech at Money 20/20.

- Jason Henrichs, head of Alloy Labs and Robert Keil with FinWise Bank, discuss the evolving landscape of community banking.

- Jason Mikula, an industry authority, and Juan Arias with FinWise Bank sit down to discuss fintech banking insights for equity investors.

- News from the FinWise Bank Website

- FinWise Bancorp Pricey for a Reason

- FinWise Bancorp Reports Third Quarter 2024 Results

- FinWise Bancorp Announces Strategic Lending Program with PowerPay to Offer Transparent and Affordable Monthly Payments for Home Improvement and Elective Healthcare Purchases

- FinWise Bancorp stock soars to 52-week high of $14.98 By Investing.com

- FinWise Bancorp Ranked #2 in American Banker’s Annual List of Top-Performing Publicly Traded Banks With Under $2 Billion of Assets

- Nasdaq Amplify Issuer Spotlight – FinWise Bank

- How FinWise Bank Plans to Survive the Storm in Banking as a Service

- A closer look at FinWise Bank and Earnest’s alliance to expand student loan financing – Tearsheet

Partner spotlight.

In September 2024, FinWise Bank announced the launch of its newest strategic lending program with PowePay, specializing in transparent lending and payment solutions through a network of contractors in the Home Improvement sector and medical providers in the Elective Healthcare space. Since its inception in 2020, PowerPay has onboarded over 12,000 Service Providers that utilize a data driven platform to process credit at the point-of-sale. The FinWise loan product, in partnership with PowerPay, will enable borrowers to obtain financial options from trusted professionals. Borrowers can also expect the same level of service throughout their journey via PowerPay’s technology platform and Customer Concierge team.

Product spotlight.

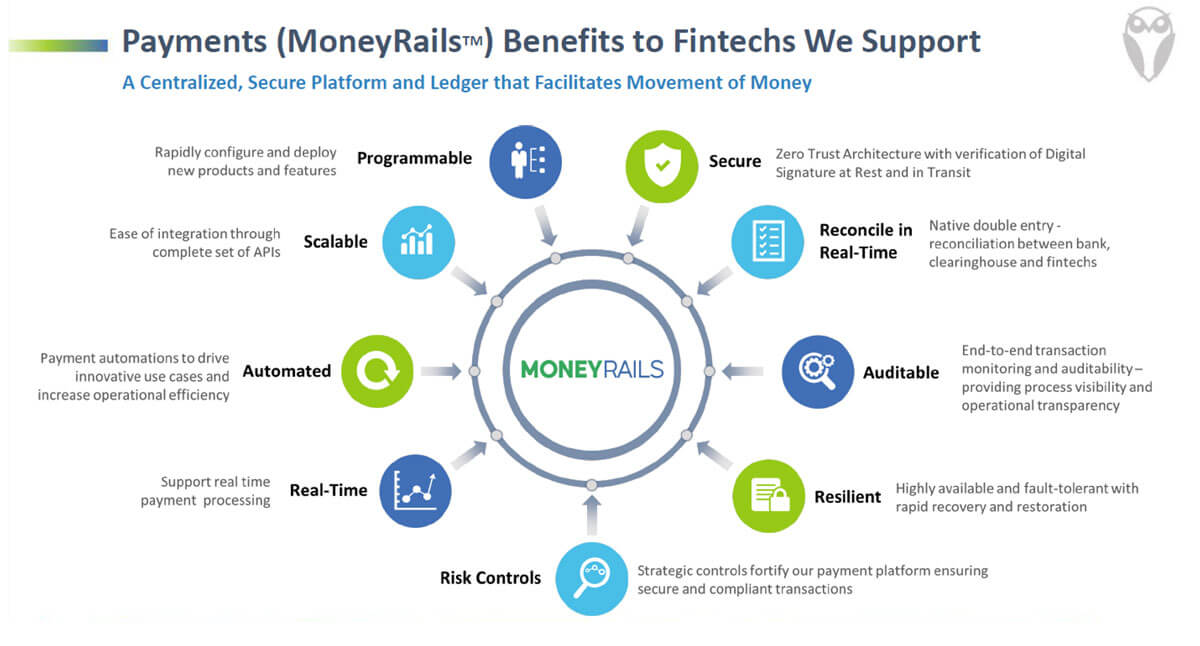

FinWise is in the process of launching its MoneyRails solution, a modern payments hub system. The Bank’s MoneyRails solution will allow fintechs and other businesses with high volume payment processing needs to safeguard deposits and process large numbers of payments via API. One of the many use cases supported by MoneyRails includes FBO accounts for neobanks or other fintechs holding deposits for end users.

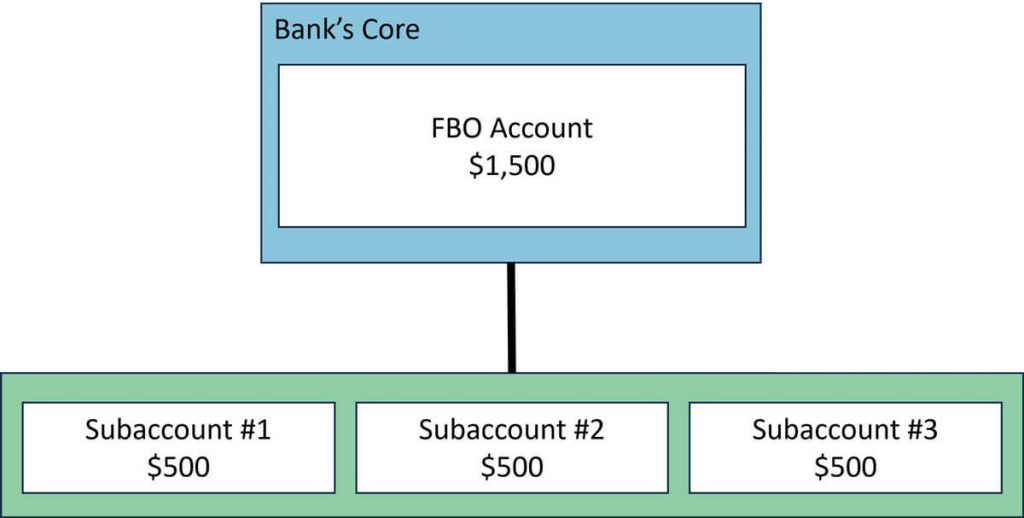

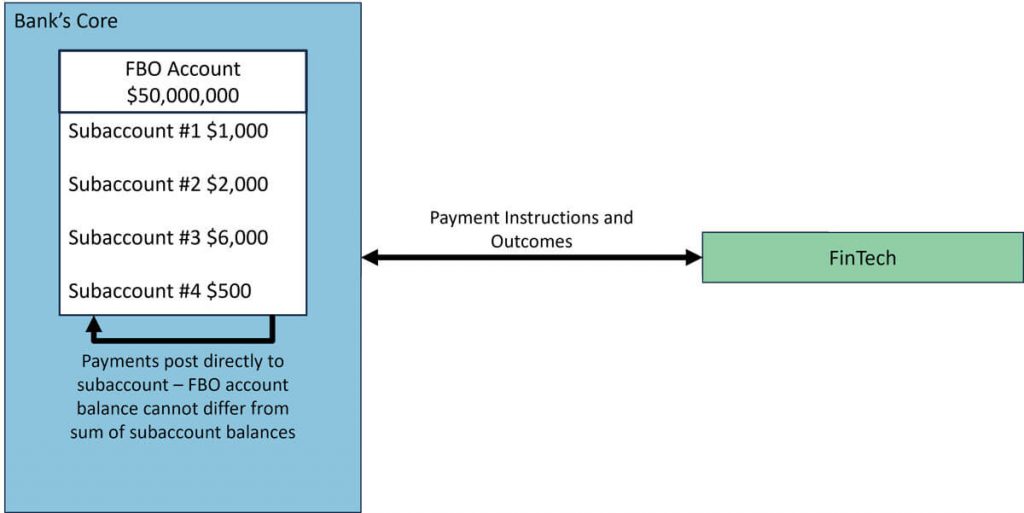

When a fintech holds deposits for various end users, they need to be able to segregate the deposits that are co-mingled in an FBO account into subaccounts. Historically, Banks have made it prohibitive for fintechs to open individual DDAs for every customer fintechs serve. As such, fintechs will generally aggregate all deposits into one or multiple FBO accounts and will rely on a ledger of record system to attribute the right balances to the right customers.

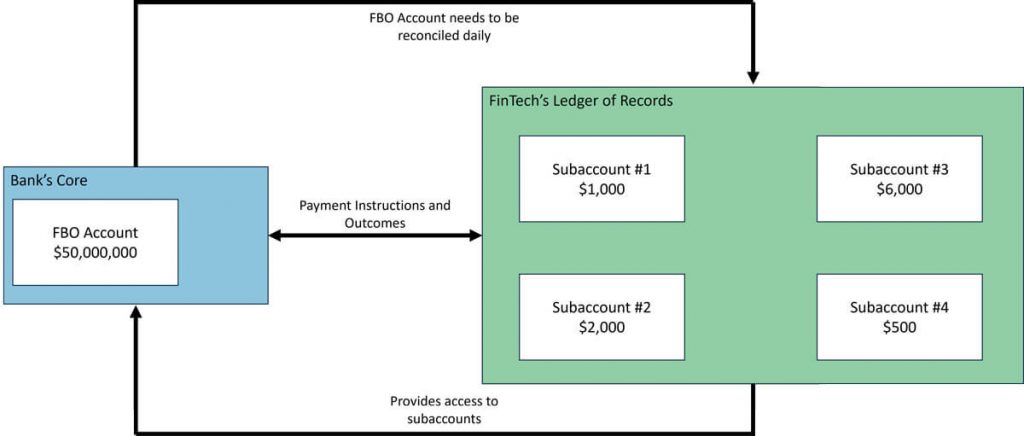

As we recently saw in industry news, this does not always go smoothly. For instance, Banks can’t reconcile the FBO balance with the subaccount balances, or a fintech suddenly shuts down operations and leaves customers without prompt access to their deposits.

Financial Institutions banking such fintechs are responsible for ensuring the right segregation of funds amongst end users of a fintech. As such, we’ve made it one of FinWise’s BaaS Sponsorship guiding principles for that the Bank will have continuous view and access to all customers’ subaccounts.

Historically, Banks playing in this space have only been able to house customers’ funds into FBO accounts without offering a solution to track subaccounts. This is the framework we call “Indirect Subledgering”. Banks receive payment instructions from fintechs, post successful transactions to the FBO account without regard for the subaccounts and report the outcomes of transactions to their fintech partners.

While FinWise will continue to support Indirect Subledgering, FinWise will be offering a “Direct Subledgering” solution where subaccounts are being housed by the Bank.

Within this framework, MoneyRails serves as the source of truth for all subaccount accounts. Transactions are posted directly to each subaccount, always reflecting the true balance and full transaction history. While this solution can serve as a standalone source of truth, it can also reconcile balances between a fintech’s ledger and other systems for additional redundancy. The Direct Subledgering framework helps FinWise mitigate risks, ensure compliance, and streamline operations. By adopting this solution, fintechs can gain real-time control over account activities, protect customer funds, and build a scalable, future-proof platform for growth.

In early 2025, FinWise will also be able to issue virtual and tokenized cards on subaccounts maintained in its environment. The Bank will be launching physical cards later in the year offering a full suite solution for those looking for bank-grade ledger of record systems.

This feature complements all our other MoneyRails offering:

- API-first platform

- Full transaction type coverage: ACH, Wire, RTP, FedNow, MasterCard RPPS and Push-to-Debit (Coming in early 2025)

- Full account type coverage: DDA, Savings, CDs

- High level of customization: fee management, spend controls, etc.

- KYC/KYB/CIP via API

- Transaction Monitoring

- Card Support: Virtual, Tokenized, and Physical (Coming in late 2025)

Thought leadership.

Guest Contributor:

Guest Contributor:

David Ritter, CEO of Privacy Lock

Section 1033 Establishes Important Rules for Financial Data Sharing & Consumer Privacy Protections

On October 22, 2024, the Consumer Financial Protection Bureau (CFPB) finalized Section 1033 of the Consumer Financial Protection Act, an important regulation that grants consumers new privacy rights and data protections over financial data. The rule moves the U.S. financial industry toward an open banking system, with the goal of creating greater competition and consumer choice for financial products and services.

Wise-up with FinWise Bank.

Sarah Grotta,

Sarah Grotta,

Deputy Fintech Officer at FinWise Bank

Sourcing a Beautiful Fintech and Partner Bank Friendship

I am often asked by program managers/fintechs how to find the right bank that understands their business and will be there for the long-term. This is particularly poignant now as some BaaS banks (that the industry is now calling Partner Banks) are scaling back their operations and occasionally unceremoniously dumping some of their partners in an atmosphere of heightened and uncertain regulatory requirements. I thought I would summarize what I have learned from my conversations with others in the industry and from two podcasts we launched on the topic. It’s an enormous topic, but here are a few key points for your consideration:

Philosophical Fit

The partnership between a program manager/fintech and a bank should be one that lasts for years. It is worth having several conversations pre-implementation to determine if the organizations see the market and approach to doing business in a similar vein. Sounds a little touchy- feely I know, but seeing eye-to-eye builds the trust that helps the partnership work. Both parties should be able to agree on their respective Ideal Customer Profile. If there isn’t alignment here, there will be an ongoing struggle as a program manager presents opportunity after opportunity to the bank that the bank may not be interested in supporting and will turn away. It’s frustrating for both parties. Program managers and their fintechs need to have a deep understanding of their programs’ functions and goals and banks need to clearly articulate what they will support.

Compliance Acumen

You were probably expecting this. Keep in mind that this is truly a two-way street. Compliance isn’t just about the bank articulating what the obligations are to facilitate a safe and compliant program. It is fair game for the program manager to fire off some questions to their bank. This can include asking about how well the bank has staffed their BSA, risk, compliance and monitoring teams. Inquire about how the bank’s last exam went with their regulators and how the bank stays current with new requirements and implements changes. A bank should welcome this line of inquiry from a prospective partner.

Communications

Again, not rocket science here, but there are a number of program managers and banks that don’t have regular contact beyond talking through daily operational items that need attention. I consider it best practice to include at least quarterly touch points in the partner agreement. This open line of communication will help to get ahead of issues before they become nuisances and helps to foster a good working relationship when something serious needs to be resolved. If either the bank or the program manager can’t commit to these meetings, you must question how serious they are to operating a good program.

I mentioned in the opening that FinWise has posted a couple of podcasts on the topic of bank and program manager partnerships with some real industry veterans. I invite you to take a listen:

|

|

|---|

Industry recognition as a Top-Performing Bank.

Thank you to all our clients and partners who helped make our most recent awards possible!

Connect with us.

Upcoming 2025 Events

- University of Utah Fintech Xchange, Salt Lake City, Utah, January 23-24 2025

- Fintech Meetup, Las Vegas, Nevada, March 10-13, 2025

Join us on a FinWise Podcast found here:

|

|

|

|---|