Hey Fintech Friends! In this edition of our FinWise newsletter, we’re excited to share a variety of top hits ranging from recent announcements, product and partner news, to insights from your favorite industry experts. Ready to Fly with FinWise? 🦉

News recap.

- Latest Podcast(s)

- The Rise, Stumble, and Forward Go of Fintech with Jason Mikula, Founder/Publisher of Fintech Business Weekly and Robert Keil, Chief Fintech Officer of FinWise Bank

- Matchmaker, Program Manager, Bank Me a Match, Find Me a Fintech, Catch Me a Catch with Christienne Genaro, Head of Strategic Bank Partnerships at Galileo and Sarah Grotta, Deputy Chief Fintech Officer of FinWise Bank

- Becoming Sponsor Bank Ready with Stan Orszula, Partner at BFKN and Sarah Grotta, Deputy Chief Fintech Officer at FinWise Bank

- News from FinWise Website

Partner spotlight.

FinWise is proud to announce its newest lending partner, Plannery, Inc., a financial wellness platform offering lending to an interesting niche market. Plannery’s platform was exclusively built with healthcare professionals in mind and is used by hospital systems as a way to offer their employees an option to become and stay debt free. Plannery is based out of San Mateo, CA and in partnership with FinWise, offers an unsecured, closed-end loan that allows its borrowers to consolidate their debt at below market interest rates where repayment is collected as a payroll deduction, eliminating missed payments and late fees. They target the more than 22 million healthcare professionals, which represents a $60B market opportunity and distribute their services as a benefit through hospitals and strategic partners.

The FinWise/Plannery loan product had a successful launch with the Phoebe Putney Health System, based in Albany, GA. They saw high engagement among their employees validating a real need for the product and recently expanded their product offering with FinWise to include a personal loan to the program, providing flexibility and access to additional funds for borrowers who need it. Plannery is continuing to evaluate their offerings to eventually expand to other states and add more hospitals and healthcare systems to their platform.

Welcome aboard, Plannery!

Product spotlight.

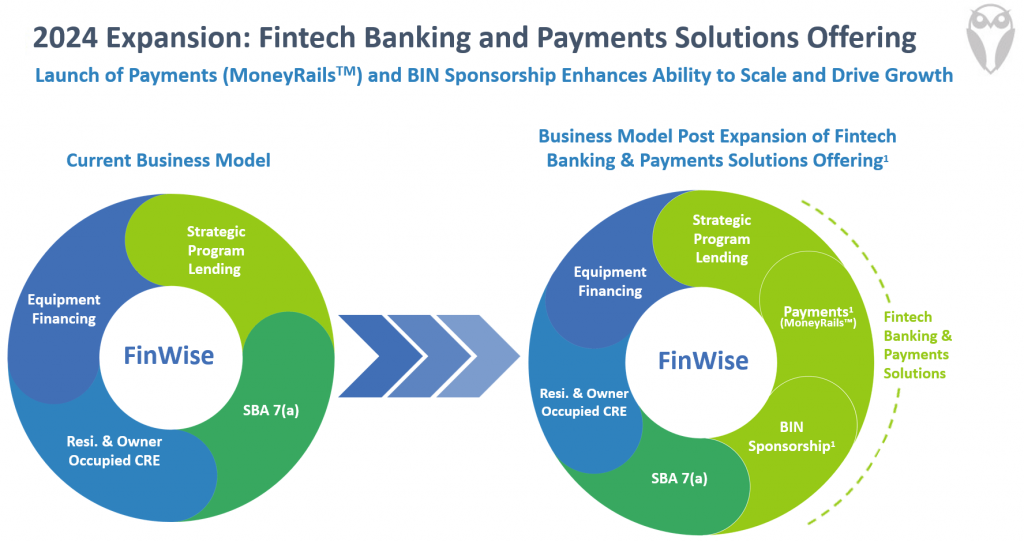

MoneyRails, the new FinWise payments hub, will bring multiple payment rails together under one application, offering users a single destination to send monetary transactions. MoneyRails will include ledgering technology, providing a strong foundation for controls, standing instructions, and connectors for 3rd party integrations. MoneyRails will support multiple payment rails, including ACH, Wire, RTP, FedNow, Mastercard RPPS, Visa Direct and can also support card servicing capabilities.

MoneyRails will be the basis for new product development at FinWise, for sponsoring new types of fintechs such as neo banks, as well as being able to reach new non-fintech clients in need of high volume payment processing. Here’s an overview of how:

Differentiators of Fintech Banking and Payments Solutions Offering.

Payments (MoneyRails™) |

Bank Identification Number (BIN) Sponsorship |

|---|---|

|

Ease of Use. Brings multiple payments types under one application. Ability to see all payments through a single source Payment Control. Allows service providers (fintechs) to embed multiple options to move money in /out of their ecosystem Cost Effective. Business rules help optimize the payment type for users’ parameters. Reduces number of bank connected systems, lowering fees and software costs Strengthens Security. Single sign-on to manage access and real time fraud controls Modern Payment Rails. Access to the latest payment types such as faster and real-time payments

|

Compliance-first Culture. Significant knowledge of compliance practices required to manage a BIN sponsorship program. Regular interactions with our regulators Differentiated Tech Approach and Integration. Provides Bank with more control for compliance oversight and more robust solutions as service providers (fintechs) expand their operations Focus. Limit number of processors, vendors and service providers to streamline efficiencies and oversight Extensive Experience. Team has nearly 90 years of combined expertise in banking, payments and fintech |

Wise-up with FinWise Bank.

Is lowering fees on FedNow the best solution for the Federal Reserve to address current needs in the industry?

In this section of our newsletter, we help readers “Wise-Up” by highlighting an article relevant to the banking and fintech industries that caught our attention. We will dig into the topic a bit and offer a point of view, because we always have an opinion! We enjoy a good dialog, so if you wish to reach out to discuss this topic or suggestions for other key industry announcements that deserve our attention, please subscribe to our email newsletters.

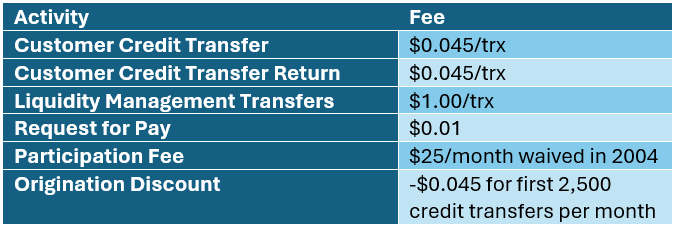

In this edition, we chose to comment on an article from PaymentsDive that reported the Federal Reserve is considering lowering fees on the FedNow real-time payments network FedNow. The article highlighted:

The Federal Reserve may consider reducing fees for its FedNow real-time payments system in the future after the service attracts more financial institution participation, or as it faces competition, according to a Wolfe Research report last month.

Wolfe Research analyst Darrin Peller interviewed Dan Baum, FedNow’s head of payments product, on a webcast last month for the research firm’s clients and issued a report on it July 21.

“Regarding future pricing, Dan noted that the Fed is offering initial discounting to get [financial institutions] on the platform and contributing volume, but that it could lower fees over time as more banks join the platform or due to competition,”

Peller wrote in the report provided to Payments Dive.

It is a bit curious that the Fed would lower prices so soon after launching. FedNow is still a relatively new payment rail (just over a year old) in comparison to other payment options, it offers nearly the same wholesale pricing as the private sector real-time payments rails, RTP, offered by The Clearing House. It is far less expensive than options such as payment cards, Visa Direct, Mastercard Send and certainly wire transfers.

Here’s the FedNow pricing to banks for 2024:

Source: The Federal Reserve

So, what’s the strategy behind reducing fees for a product that clearly offers value for account-to-account payments that settle in real time at all hours, every day and are irrevocable? While the Fed trails the Clearinghouse in terms of volume processed, it is unlikely that lowering fees will have a meaningful impact to attract more financial institutions to join its network. Launching a new payment network is not for the faint of heart and requires a commitment of resources on the part of a financial institution that is far, far greater than the impact of the difference of a couple of pennies on a transaction.

Perhaps the Fed is considering lowering fees as a way of making good on its commitment to provide competition in the market, as it stated when it first announced its decision to deploy its real-time network and offer an alternative to RTP. It is an easy decision for the Fed to make as they are under no obligation to turn a profit on this service. Isn’t there a better approach, however? As any good product developer would tell you, the way to create true competitive distinction is through indispensable features. One option is for the Fed to focus on developing safe and convenient cross-border options, an area of the payments industry that is in need of modernization. The Fed has unique relationships with the central banks in other countries that could be leveraged to help move development forward. This could benefit FedNow with a first to market advantage, but also support the entire industry.

Real-time payment options are in their infancy and need to better mature to gain a footing in the U.S. payments environment. While these networks evolve deliberately and just plain slowly, companies, fintechs and financial institutions will need to invest in multiple payment types to achieve their payment objectives whether that transaction embodies speed, reach, availability (24X7x365), refutability or cost. The slow speed of the deployment of FedNow is actually driving innovation of their competitors from the card network payments to same day ACH. And in the end will support creative new products with positive outcomes.

Industry recognition as a Top-Performing Bank.

Not to toot our own horn too much, but we are proud of our most recent awards. Thank you to all our clients and partners who helped make this possible!

Connect with us.

Upcoming Events

Join us on a FinWise Podcast found here:

|

|

|

|---|