Our MoneyRails™ payments hub helps you safeguard deposits and process large numbers of payments via API by offering multiple payment types under one platform providing you a single destination to send, receive and store monetary transactions.

API-Driven Solution:

Access and configure MoneyRails™ easily through APIs, an online portal, and file-based messaging, ensuring flexibility for everyone.

Efficient Modern Payments:

Experience fast and flexible payment options like next- and same-day ACH, wires, MasterCard RPPS, Push-to-Debit, RTP, and FedNow, ensuring quick and convenient transactions for efficiency.

Saves Money:

Simplify your finances with one relationship for various payment types, ledgering, and banking services. Supports all account types, including DDAs, CDs, MMAs, and FBO accounts, as well as ledger of record services.

MoneyRailsTM – A Modern Payments Hub System

Our MoneyRails™ platform will allow fintechs and other businesses with high volume payment processing needs to safeguard deposits and process large numbers of payments via API. With MoneyRails™ businesses and fintechs can use FinWise for all their payment needs without having to partner and implement with multiple vendors.

This opportunity is intended to minimize friction, reduce costs, and mitigate fraud risk by leveraging a multi-faceted technology, customized for the bank and its customers. One of the many use cases supported by MoneyRails™ includes For-Benefit-Of (FBO) accounts for neobanks or other fintechs holding deposits for end users.

More About FinWise Bank’s MoneyRails™ Solution

How MoneyRails™ Helps Fintechs Hold Deposits for End Users

When a fintech holds deposits for various end users, it needs to be able to segregate these funds that are co-mingled in an FBO account into subaccounts. Historically, banks have made it cost-prohibitive for fintechs to open individual DDAs for every customer fintechs serve. As such, fintechs will generally aggregate all deposits into one or multiple FBO accounts and will rely on a ledger of record system to attribute the right balances to the right customers.

MoneyRails™ Features:

MoneyRails™ offers multiple payment types under one platform providing users a single destination to send, receive and store monetary transactions.

- API-driven solution

- Saves money

- Modern payments

- Scalable deployment

- Improves control

- Better security

- Ledger services

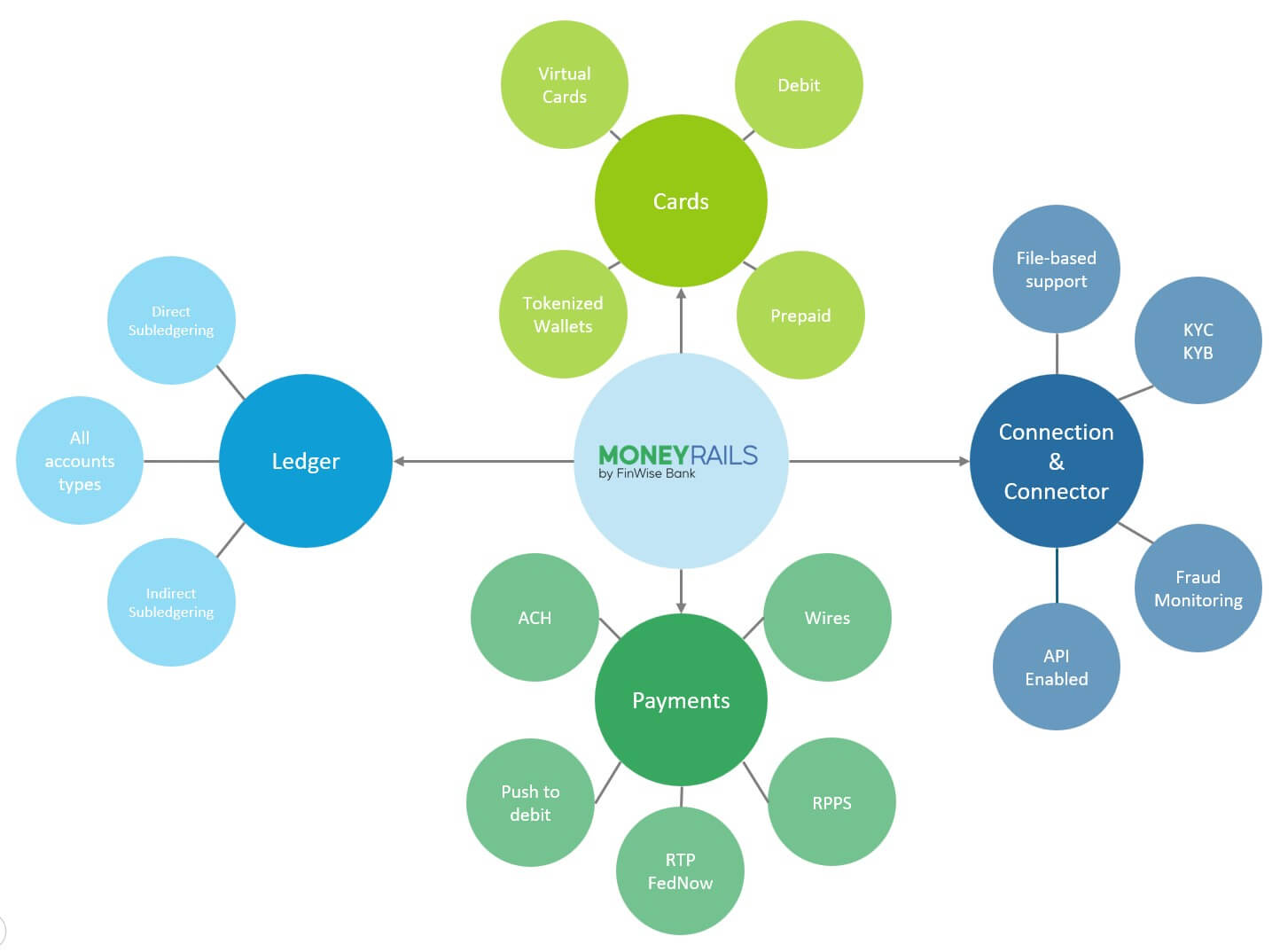

MoneyRails™ Map of Services

Why FinWise Bank.

We have stepped forward to advance the future of banking, lending, card and payment solutions for leading fintechs. We provide Strategic Program lending, BIN Sponsorship, a Payments Hub (MoneyRails™) and traditional Lending programs such as SBA 7(a), Owner Occupied RE, and Leasing. As part of Strategic Program Lending, FinWise also provides a Credit Enhanced Balance Sheet Program, which addresses the challenges that lending and card programs face securing warehouse facilities and managing capital requirements. Through its compliance oversight and risk management-first culture, the Company is well positioned to guide fintechs through a rigorous process to facilitate regulatory compliance.

Who We Serve

We help fintech brands disrupt banking for the better.

Our flexible credit, lending, cards and payments solutions eclipse traditional banking capabilities, removing critical roadblocks to fintech innovation.

Secure and Insured

Your trusted financial partner.

Our commitment to your financial well-being means we never sacrifice credibility for progress.