Hey Fintech Friends! In this edition of our FinWise newsletter, we’re excited to share a variety of top hits ranging from recent announcements, product and partner news, to insights from your favorite industry experts. Ready to Fly with FinWise? 🦉

News recap.

- Latest Podcast(s)

- Credit Card Innovation and FinTech Trends with Sunil Singh

- The Evolving Role of Sponsor Banks in Fintech with Visa’s Brittany Decker

- 2024 Year in Review, FinWise Team

- Navigating the 1033 Rule, guest Matt Faso, Trustly

- Latest Update(s)

- FinWise Bancorp’s CEO Talks Strategy Behind Fintech Success by MarketBeat

- FinWise Reports Fourth Quarter and Full Year 2024 Results

- FinWise Investor Presentation, January 2025

- Congrats to the FinWise IR team, Juan Arias (Head of IR, CorpDev, Marketing) and Nathan Mills (VP, Marketing) for being shortlisted as a finalist in the prestigious 2025 IR Magazine Awards. This is a testament to the team’s outstanding work and dedication.

Partner spotlight.

In September 2024, one of FinWise Bank’s Strategic Partners, Stride Funding, rebranded to Clasp to better reflect its mission: solving recruitment and retention challenges through innovative, mutually beneficial solutions for employers and talent. Clasp works with current students in higher education to match them with companies looking to fill roles across their organization. Once matched, the organization agrees to pay some or all of the student’s future loan payments over a specified work commitment.

Clasp’s retention-driven recruitment platform tackles talent shortages by helping employers attract and retain top talent while reducing student debt and fostering long-term relationships between employees and organizations. With more than 10,000 individuals currently on the platform, Clasp focuses on the healthcare industry, partnering with healthcare systems ranging across academic, pediatric, home health, optometry, and veterinary organizations. Clasp also works with one of the largest semiconductor companies and has plans to expand into other industries as the company grows.

Product spotlight.

Real Time Interoperability

FinWise has deployed its MoneyRails™ solution, a modern payments hub system, and will be publicly launching it soon. The Bank’s MoneyRails™ solution will allow fintechs and other businesses to safeguard deposits and process large numbers of payments via API.

One of the key features of MoneyRails™ is its ability to seamlessly route payments to the appropriate real-time payment network, ensuring that transactions are processed with speed and precision. Using our proprietary interoperability endpoint, payments are automatically routed based on the recipient’s routing number. Whether the receiving party banks with a TCH RTP-enabled institution or a FedNow participant, our system will direct the payment to the correct network, minimizing delays and ensuring the fastest possible settlement.

If the receiving institution does not support either TCH RTP or FedNow, the platform will automatically default to pushing an ACH, ensuring that the payment is still processed smoothly. This fallback mechanism guarantees that no payment goes unprocessed, even if the receiving bank is not real-time enabled.

Benefits:

- Transactions are settled in real time, reducing the need for overnight clearing or batch processing.

- With both TCH RTP and FedNow, fintechs can offer broader coverage, catering to institutions that operate on either network.

- Our platform’s dual support for TCH and FedNow ensures that payments can be routed through the most appropriate rail, providing the highest level of uptime and reliability.

- The automatic routing function eliminates the complexity of managing multiple payment networks, and the ACH fallback ensures payments are completed even for banks not yet on real-time rails.

Differentiators of Fintech Banking and Payments Solutions Offering.

Payments (MoneyRails™) |

Bank Identification Number (BIN) Sponsorship |

|---|---|

|

Ease of Use. Brings multiple payments types under one application. Ability to see all payments through a single source Payment Control. Allows service providers (fintechs) to embed multiple options to move money in /out of their ecosystem Cost Effective. Business rules help optimize the payment type for users’ parameters. Reduces number of bank connected systems, lowering fees and software costs Strengthens Security. Single sign-on to manage access and real time fraud controls Modern Payment Rails. Access to the latest payment types such as faster and real-time payments

|

Compliance-first Culture. Significant knowledge of compliance practices required to manage a BIN sponsorship program. Regular interactions with our regulators Differentiated Tech Approach and Integration. Provides Bank with more control for compliance oversight and more robust solutions as service providers (fintechs) expand their operations Focus. Limit number of processors, vendors and service providers to streamline efficiencies and oversight Extensive Experience. Team has nearly 90 years of combined expertise in banking, payments and fintech |

|

Target Customers:

|

|

Thought leadership.

Guest Contributor:

Guest Contributor:

Ben Jackson, Chief Operating Officer, Innovative Payments Association

Leveraging Regulatory Compliance for Innovation and Success

Technological advancements, fintech failures, and regulatory changes have led to fintech value chains receiving scrutiny from both regulators and banks.

This underscores the need for better collaboration on compliance among all participants in the financial services value chain.

The trend started in 2022, when the CFPB announced that it would invoke a “dormant authority” from the Dodd Frank Act of 2010 to examine nonbank financial services companies that “the CFPB has reasonable cause to determine pose risks to consumers.”

This marked a shift in regulatory compliance responsibilities, spreading the burden beyond banks to their partners across the value chain.

The issuance of a final rule in 2024 around open banking that requires companies to share data with one another also has the various participants looking at each other more closely.

Wise-up with FinWise Bank.

Sarah Grotta,

Sarah Grotta,

Deputy Fintech Officer at FinWise Bank

Payment App X Money will Roll Out This Year

Does the U.S. Want Another P2P App?

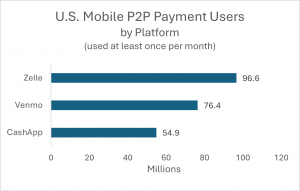

It’s often said that consumers are creatures of habit, rarely changing the payment methods they’ve used for years. This is why we still see significant amounts of cash and checks being used, and why many consumers hold onto the first credit card they were ever issued, despite the availability of arguably better alternatives. However, I would suggest that it’s not so much an unwillingness to change, but rather that few new payment forms have emerged that materially improve users’ monetary activities. An exception to this rule was the emergence of good (emphasis on “good”) person-to-person (P2P) apps. These apps provided a real payment solution that solved the inconvenience of paying others, particularly for low-dollar amounts. The growth of P2P payments has been nothing short of remarkable. P2P apps have gone from nascent use ten years ago to now being present on three-quarters of mobile phones in the U.S., responsible for well over a trillion dollars in processed volume. Here’s the breakdown of the use of the most popular P2P app brands by number of users:

Source: EMARKETER Forecast, March 2024

Source: EMARKETER Forecast, March 2024

At the Consumer Electronics Show (CES) this year, Linda Yaccarino, CEO of X Corp (formerly Twitter), announced the upcoming launch of X Money, a P2P payments app similar in functionality to PayPal’s product. On January 28, it was made public that X had partnered with Visa to provide the ability to connect users’ debit card to the app and use Visa Direct to conduct peer-to-peer money movement. So why does X (formerly Twitter) want to get into the payments game? I believe it has everything to do with its leader and partial owner, Elon Musk. Long before SpaceX and Tesla, Elon developed products for an online banking venture of his called, interestingly enough, X.com. This was later purchased by none other than PayPal. Leading a car company, social media app, and space exploration firm, among other initiatives, he has decided to return to his roots and launch a payment solution as part of the X app, leveraging its millions of current users.

The company has already secured money transmitter licenses in over 30 states, which makes this sound like a real endeavor. However, I think it may be a little too late for yet another P2P app in the already saturated U.S. market. As with any new product looking to differentiate itself, X should consider the ways they might be able to break through and stand out:

- It’s not on price. Nearly all P2P apps today have very few fees, and most fees that do exist are avoidable.

- It’s not ease of use. P2P apps are intuitive, and users are comfortable with them.

- It’s unlikely to be better fraud controls. The issues of P2P app fraud are well known and have the attention of regulators and legislators alike. While this product could use a better fraud detection solution, the issue plaguing this payment form is authorized transaction fraud. This isn’t something that a company can just throw a lot of technology at to solve. I doubt X can make an impact here.

- Could it be improved or enhanced features and functionality? Well, maybe. There are discussions that this app will be or should be able to conduct purchases in cryptocurrencies. This would certainly fit the ethos of many X users and followers, but few merchants offer the opportunity to take digital currencies. As those of us in payments know, building a network of accepting merchants is hard work and takes decades. What about tying the app to Tesla and other cars (including self-driving taxis) for in-vehicle payments at drive-throughs, tollways, and any other payments made while driving? There will be some takers here among rabid X users and Tesla drivers, but this is getting to be rather old tech that hasn’t found an audience. The networks were working on pay-by-car 20 years ago, and it only has modest uptake. I think the audience for this is small.

The only way I believe X Money takes off is if X develops the “super app” that has been much discussed but has never appeared in the U.S. A super app is a single app with many hundreds of associated mini-apps like WeChat in China. In the WeChat example, consumers can pay bills, make appointments, grab a ride, order food, file their taxes, and send money all in one place, all supported with a single payment type.

I think the viability of X Money developing a super app that catches U.S. consumers’ eyes to the extent that it would impact the U.S. payments market is very low. It worked in China because the payment systems were so antiquated that the apps were a significant leap forward in convenience and solved significant issues. We aren’t faced with these same challenges. It’s hard to discount the ambitions of the richest man in the world, but I don’t think there is anything to see here.

Industry recognition as a Top-Performing Bank.

Connect with us.

Upcoming 2025 Events

- Future Digital Finance Connect, New Orleans, LA, February 24-25

- Fintech Meetup 2025, Las Vegas, NV, March 10-13

Join us on a FinWise Podcast found here:

|

|

|

|---|